ADMINISTRATION OF PART-TIME EMPLOYEES AND

THE ALLIANCE RETIRAL FUND (ARF)

The purpose of this document is to:

-

Define Full and Part-Time employees and the ARF membership

criteria for each. (ARF is separate from any

extended health benefit the employer may offer and the

membership criteria is different.)

-

Outline a process for ARF employers (including

churches) to administer membership in the ARF as it relates to

part-time employees so pension and legislation is

satisfied.

The Full-Time and Part-Time eligibility rules are as

follows:

Full-Time Employees are required to enrol in ARF starting with

their first pay.

Full-Time employees are defined as those who, according to

their Employment Agreement:

- work 30 hours or more per week and

-

are not hired on a contract basis with a

specific end date (for example, a 1- or 2-year contract)

Part-Time Employees must have the

option

to join ARF when provincial legislated criteria are met.

The employer is responsible to let the employee know

when the employee is eligible.

Part-Time employees are defined as those who, according to their

Employment Agreement,

- work less than 30 hours per week and

-

are not hired on a contract basis with a

specific end date (for example, employees hired on a 2-year

contract)

Provincial legislated criteria for Part-Time employees:

-

As of July 2023, the criteria for employees in B.C, Alberta,

and New Brunswick are:

-

Has been employed for 24 consecutive months and satisfied one of

the following:

- Has earned at least 35% of the YMPE

(The YMPE is the Yearly Maximum Pensionable Earnings set by the

CRA each year and is $66,600 for 2023.)

-

As of July 2023, the criteria for employees in Ontario,

Manitoba, Saskatchewan, and Nova Scotia are:

-

Has been employed for 24 consecutive months and has satisfied

one of the following:

-

Has earned at least 35% of the YMPE in each of the last 2 years

or

-

Has worked at least 700 hours in each of the last 2 years.

The other provinces have slight variations on these themes. Please contact Reuter Benefits for those rules at

retire@reuterbenefits.com.

Once a part-time employee satisfies the criteria above, he/she

must be offered membership in ARF.

However, the employer has the option to be more

generous and offer membership to their Part-time employees at

anytime before those rules are satisfied. The

Part-time employee is under no obligation to

accept the offer at any time.

Contract Employees cannot join ARF. When, according to their Employment Agreement, the employee is no

longer on contract and becomes:

- Full-Time, he/she must join ARF.

-

Part-time, the criteria listed above for Part-time employees

apply.

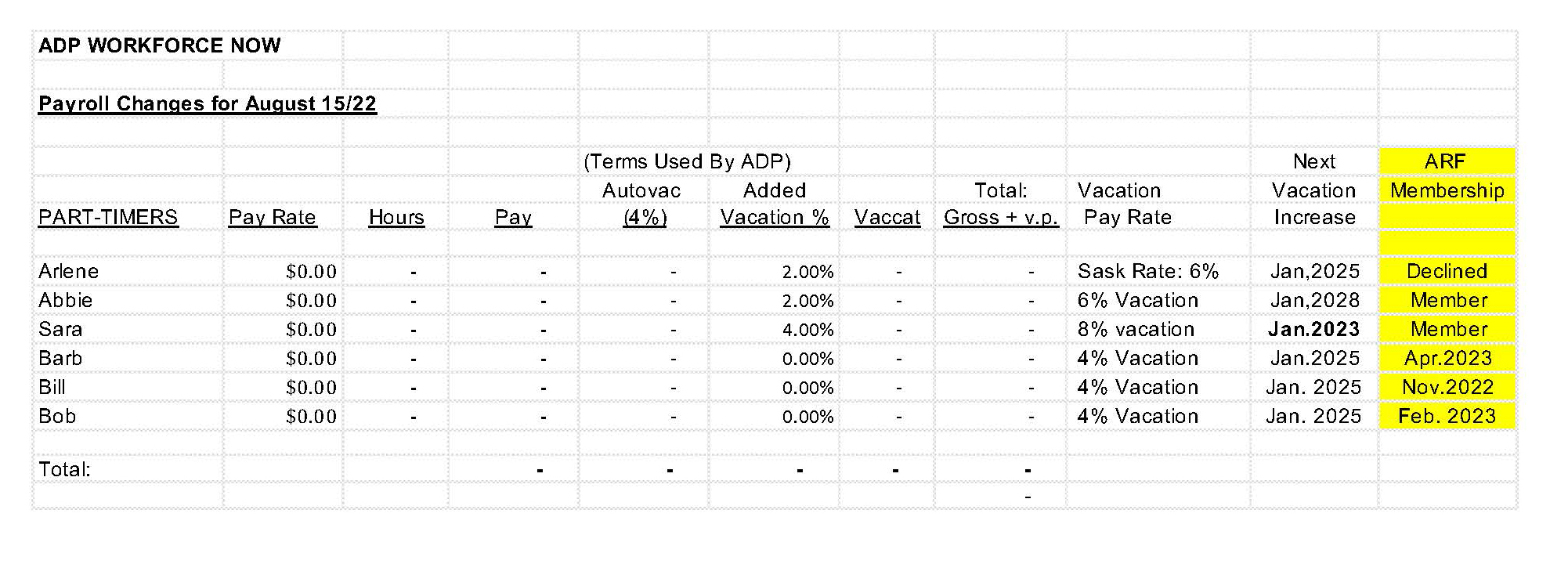

ADMINISTRATION PROCESS FOR PART-TIME EMPLOYEES:

To track part-time employees’ eligibility for membership in ARF,

one can create a spreadsheet like this:

The highlighted column shows if the employee has accepted the

offer of ARF membership, been offered and declined it, or when

they have fulfilled the 24-month time requirement. When they have satisfied the time requirement, check the YMPE and

hours worked requirements (if needed) to see if they qualify for

ARF membership.

If they qualify, let them know verbally and send them the offer on

the following page, which must be completed by email.

When you receive the completed form, file it in their personal

file. If they do not complete it, file a copy of the

email containing the offer in their personal file. Now you have a record

that the offer was made and when it was made. This

will protect you and the church if the employee claims at a future

date that they were not made aware of ARF eligibility.

This Administrative Process is a sample of how other Alliance

employers administer part-time employees and their ARF

eligibility. It is provided as an aid, not a

requirement. Feel free to adjust it to meet your

payroll processing needs.

July 2023

Offer Form